August 18 2022

PSSLAI LOAN CALCULATOR What is the interest rate on a Public Safety Savings and Loan Association loan?

Best online loans

When it comes to banking, the Philippines has a wide variety of options for consumers. There are many large banks as well as smaller credit unions and cooperatives. One such cooperative is the Public Safety Savings and Loan Association, Inc. (PSSLAI), which was founded in 1957 in Manila. In this case study, we will take a closer look at PSSLAI and what makes it unique compared to other financial institutions in the country.

PSSLAI was created to provide financial assistance to public safety employees, such as firemen, policemen, and military personnel. In addition to offering savings and loan services, PSSLAI also provides its members with insurance products. Because of its focus on public servants, PSSLAI has been able to maintain a very high level of trust among its clients.

In terms of deposits, PSSLAI offers several options including regular savings accounts, time deposit accounts, and foreign currency deposit accounts. For loans, the cooperative offers both short-term and long-term financing. Some of the other products and services that PSSLAI provides include ATM services, debit cards, online banking, and mobile banking.

One of the things that set PSSLAI apart from other financial institutions is its focus on customer service. The cooperative has a team of dedicated customer service representatives who are always available to answer questions and resolve issues. In addition, PSSLAI has a very user-friendly website that makes it easy to find information and conduct transactions.

Overall, PSSLAI is a great option for public servants in the Philippines who are looking for a reliable and trustworthy financial institution. The cooperative offers a wide range of products and services, as well as excellent customer service. If you are looking for an alternative to traditional banks, then PSSLAI is worth considering.

PSSLAI is just one of the many options available to consumers in the Philippines. What are some of the other banking options that you are familiar with? Have you ever used a credit union or cooperative before? Let us know in the comments below!

In addition to PSSLAI, there are many other financial institutions in the Philippines including traditional banks, credit unions, and cooperatives. Each of these organizations has its own unique set of products and services. If you are looking for an alternative to traditional banks, then a credit union or cooperative is worth considering. Some of the other banking options that you may be familiar with include BDO (Banco de Oro), BPI (Bank of the Philippine Islands), Metrobank.

Who is eligible for membership in the Public Safety Savings and Loan Association in the Philippines?

Who is eligible for membership in the Public Safety Savings and Loan Association in the Philippines? Nearly everyone! The Association is open to all public safety employees, including police officers, firefighters, EMTs, and military personnel. In addition, family members of public safety employees are also eligible for membership. This means that if you have a spouse or parent who is a public safety employee, you can join the Association as well. The only exception is that government employees are not eligible for membership. So if you're a civil servant, you'll need to look elsewhere for your financial needs. But for everyone else, the Public Safety Savings and Loan Association is a great way to save money and get access to low-interest loans. Contact your local public safety office to learn more about how to join.

What is the interest rate on a Public Safety Savings and Loan Association loan?

Interest rates on loans from the Public Safety Savings and Loan Association are very reasonable. The current interest rate is 6%, and the loan can be repaid over up to 10 years. This makes the loan an excellent option for those who are looking to finance the purchase of a new home or vehicle. The Public Safety Savings and Loan Association is a non-profit organization, and all of the proceeds from the loan go towards supporting police, fire, and other emergency services. This makes the loan not only affordable but also supportive of important public safety initiatives. When you take out a loan from the Public Safety Savings and Loan Association, you can be confident that you are getting a fair interest rate and that your money is going towards a good cause.

Mobile App

FAQ

Why does a member need to update Membership?

How to update membership when the member is in another country or overseas?

- The Representative can come to the office to collect membership forms and send them to the member who is abroad. The membership form can also be emailed directly to the overseas member and printed.

- Through Social Media (Facebook messenger or Viber), the New Account Representative of PSSLAI Head Office ivi-videocalls the member to see, talk, and be guided in correctly filling out the membership form.

- The Representative will deliver the original documents to the PSSLAI office. An Authorization letter signed by the member is required in case he will get his PSSLAI ID (and passbook) through a Representative.

Why is my PSSLAI ID not being read using the kiosk machine?

If the Regular member voluntarily terminates the membership, what happens to the membership of his Associate members?

What are dormant accounts?

How much is the required take home pay of PNP, NUP and BFP

NUP (PNP) – Php 5,000

BFP- Php 5,000

What loan can be availed so as not to be forced to withdraw the deposit to still get the high dividend?

What is an MRI?

PSSLAI Branches & Offices

- CORPORATE OFFICE: PSSLAI Corporate Office, 524 EDSA, Brgy Socorro, Cubao, Quezon City, 1109, Philippines; Monday to Friday 8:30AM-4PM; (02) 8705-21-00, Smart: 0998 962-2081, Sun: 0925 545-7493, Globe: 0917 856-7443

- CAMP CRAME BRANCH: G/F Kiangan Hall, Camp Crame, Quezon City; Monday to Friday 8:30AM-4PM; (02) 8723-26-52, (02) 8723-29-76

- RIZAL: Kong, Day, Sen & Han Bldg., Unit 2A 2nd Floor, Cabrera Rd., Brgy. Dolores, Taytay, Rizal; Monday to Friday 8:30AM-4PM; Mobile: 0919 083-3562

- TAGUIG: PSSLAI Bldg., Southern Police District HQ, Lawton Ave., Western Bicutan, Taguig City; Monday to Friday 8:30AM-4PM; Mobile: 0919 071-6131, 0999 992-6174

- CALOOCAN: Nice Hotel Bldg., GF 1275 Samson Road, cor. Lapu-Lapu St., Caloocan City; Monday to Friday 8:30AM-4PM; Mobile: 0999 991-5239

- BAGUIO: PSSLAI Bldg., Ben Palispis Highway, Brgy. BGH Compound, Baguio City; Monday to Friday 8:30AM-4PM; 0917 830-5825, 0908 891-4457

- CABANATUAN: PSSLAI Bldg. Del Pilar St., Brgy. Sangitan New, Cabanatuan City; Monday to Friday 8:30AM-4PM; 0933 411-7982, 0919 083-3557

- CALAMBA: PSSLAI Bldg. Mayapa Road, Brgy. Mayapa, Calamba City; Monday to Friday 8:30AM-4PM; Landline: (049) 832-2298, Mobile: 0908 884-0774, 0917 833-7606

- CALAPAN: PSSLAI Bldg., Cattleya St., Brgy. Suqui, Calapan City; Monday to Friday 8:30AM-4PM; Mobile: 0998 968-5346, 0917 803-2948

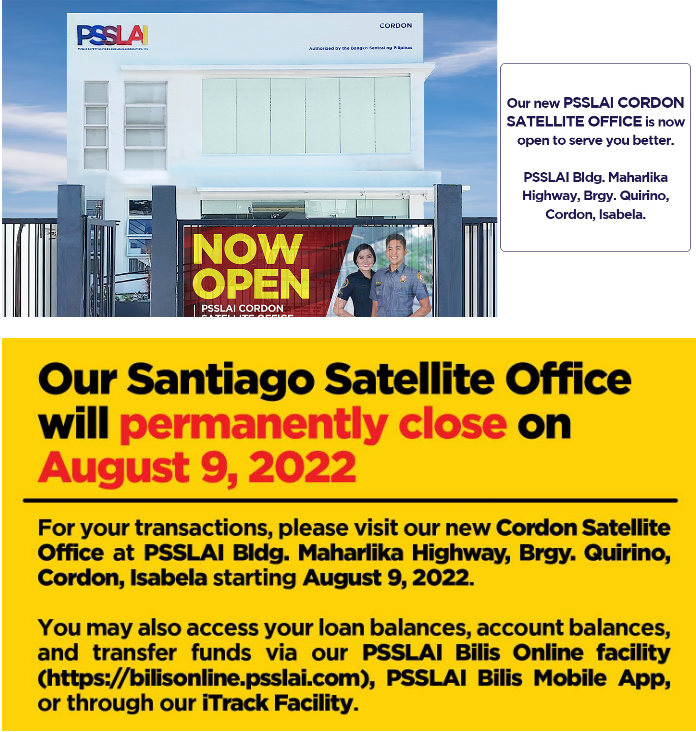

- CORDON: PSSLAI Bldg. Maharlika Highway, Brgy. Quirino, Cordon, Isabela; Monday to Friday 8:30AM-4PM; Landline: (078) 6820260, Mobile: 0998 968-5345

- DARAGA: PSSLAI Bldg., Rizal St., Brgy. Sagpon, Daraga, Albay; Monday to Friday 8:30AM-4PM; 0908 884-0775, 0917 833-7735

- LAOAG: PSSLAI Bldg., Paterno St., Brgy. 23-San Matias, Laoag City; Monday to Friday 8:30AM-4PM; 0919 083-3564

- LINGAYEN: PSSLAI Bldg., Alvear St., Brgy. Poblacion, Lingayen, Pangasinan; Monday to Friday 8:30AM-4PM; 0949 880-0032, 0999 990-3071

- LUCENA: PSSLAI Bldg., Doña Aurora Blvd., Brgy. Gulang Gulang, Lucena City; Monday to Friday 8:30AM-4PM; 0998 960-6265, 0939 937-1965

- NAGA: 47 Barlin St., Brgy. Sta. Cruz, Naga City; Monday to Friday 8:30AM-4PM; Mobile: 0928 680-6012, 0919 071-6144

- OLONGAPO: PSSLAI Bldg., National Road, Brgy. Barretto, Olongapo City; Monday to Friday 8:30AM-4PM; Mobile: 0999 228-7505

- PUERTO PRINCESA: IMTC Bldg., Purok UHA, National Highway, Brgy. Tiniguiban, Puerto Princesa City, Palawan; Monday to Friday 8:30AM-4PM; Mobile: 0919 083-3651

- PUERTO PRINCESA: IMTC Bldg., Purok UHA, National Highway, Brgy. Tiniguiban, Puerto Princesa City, Palawan; Monday to Friday 8:30AM-4PM; Mobile: 0919 083-3651

- SAN FERNANDO, LA UNION: PSSLAI Bldg., Brgy. Parian, San Fernando, La Union; Monday to Friday 8:30AM-4PM; Mobile: 0917 807-6703, 0908 884-0771

- SAN FERNANDO, PAMPANGA: PSSLAI Bldg., Mac Arthur Highway, Brgy. San Nicolas, San Fernando, Pampanga; Monday to Friday 8:30AM-4PM; Landline: (045) 963-1174, Mobile: 0917 832-6889, 0908 884-0453

- SILANG: Unit A #5 E. Montoya St. cor. M.H. Del Pilar, Brgy. Poblacion 1, Silang, Cavite; Monday to Friday 8:30AM-4PM; Mobile: 0956 489-9689

- TUGUEGARAO: PSSLAI Bldg., National Highway, Alimannao, Tuguegarao, Cagayan; Monday to Friday 8:30AM-4PM; Landline: (078) 3771004, Mobile: 0908 884-0772, 0917 828-3307

PSSLAI is supervised and authorized by the Bangko Sentral ng Pilipinas to conduct business and is endorsed by the PNP, BFP and PPSC leadership. For more inrormation please visit the official website psslai.com.

Related articles