August 08 2022

What money lending companies give unsecured loans in the Philippines?

Best online loans

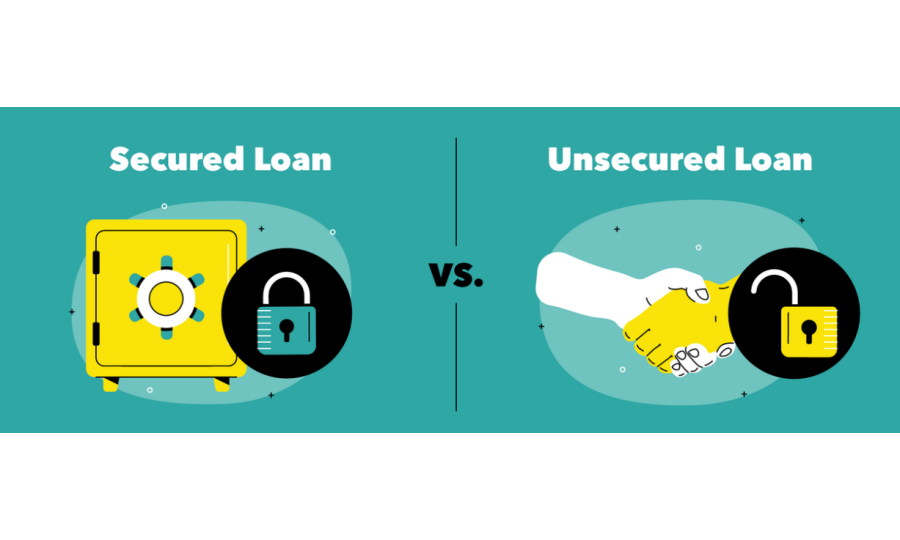

When it comes to loans, there are two main types: unsecured and secured. So, what's the difference?

- An unsecured loan is a loan that does not require any collateral. This means that if you cannot repay the loan, the lender cannot seize any of your assets to cover the costs.

- A secured loan, on the other hand, is a loan that is backed by some form of collateral. This could be a car, a home, or even stocks and shares. If you cannot repay the loan, the lender can take possession of your asset to cover their losses.

So, which type of loan is right for you? Well, that depends on several factors. If you have bad credit, then an unsecured loan might be your only option. However, if you have good credit and can provide collateral, then a secured loan might be the better choice.

Ultimately, it all comes down to your circumstances. So, make sure you speak to a financial advisor before making any decisions.

What are some of the benefits of taking out an unsecured loan? One of the main advantages is that they can be easier to qualify for than their secured counterparts. This is because there is no collateral required, so lenders are more willing to take on the risk. Additionally, unsecured loans can be used for a variety of purposes, including debt consolidation, home improvements, and even starting a business.

On the other hand, secured loans often come with lower interest rates because they are considered to be less risky for lenders. This is because if you default on the loan, the lender can simply take possession of your collateral to recoup their losses. Additionally, secured loans can often be paid back over a longer period than unsecured loans, giving you more flexibility when it comes to repaying the debt.

So, there you have it: a brief overview of the difference between unsecured and secured loans in the Philippines. Be sure to speak to a financial advisor before making any decisions

What money lending companies give unsecured loans in the Philippines?

There are a few money lending companies in the Philippines that give unsecured loans. Unsecured loans are a type of loan that does not require collateral, which means that you don't have to put up any property or assets as security for the loan.

This makes unsecured loans a bit more risky for lenders, so they typically charge higher interest rates than secured loans.

Money lending companies that give unsecured loans in the Philippines include:

These companies offer loans of up to PHP 20,000 with repayment terms of up to 12 months. Interest rates on unsecured loans from these companies range from 1.5% to 3% per month.

To apply for an unsecured loan from one of these companies, you will need to be at least 21 years old and have a regular income of at least PHP 10,000 per month.

You will also need to have a valid ID and an active bank account.

If you want to take unsecured fast loan in 15 minutes see all offers in our site maxbank.com.ph

Related articles